Ripple (XRP) price opened trading at $0.53 on Feb. 26, down 8% from its monthly peak of ot $0.58 recorded on Feb. 15, can whale investors spark rebound in March?

After its positive performance in the first-half of February topped out at $0.58, XRP price has been on a steep downward trend in the last past week. However, early signals of a positive start to March 2024 have emerged as whale investors begin to buy the dip.

XRP price has underperformed the altcoin market average in February

XRP price started February 2024 positively, rising 19% from $0.49 to $0.58 between Feb. 1 and Feb. 16, but since then, it has struggled to sustain the momentum.

In the second-half of February, XRP has fallen behind the overall altcoin market average, losing 8% of its gains as prices dipped toward $0.53 at press time on Feb. 26.

With top performers in the DeFi and Crypto AI sectors led by capital flowing towards Ethereum, and the chart-topping NVIDIA corp, the Ripple-backed token has fallen down the pecking order in terms of media attention and market demand.

TradingView’s TOTAL2 chart, estimates that the global altcoin markets have received capital inflows worth $194 billion in February 2024, representing a whopping 26% growth. In comparison XRP 9% month-to-date performance has fallen short of the market average.

However, recent on-chain movements trends observed among whale investors suggest this trend could flip bullish for XRP in the coming weeks.

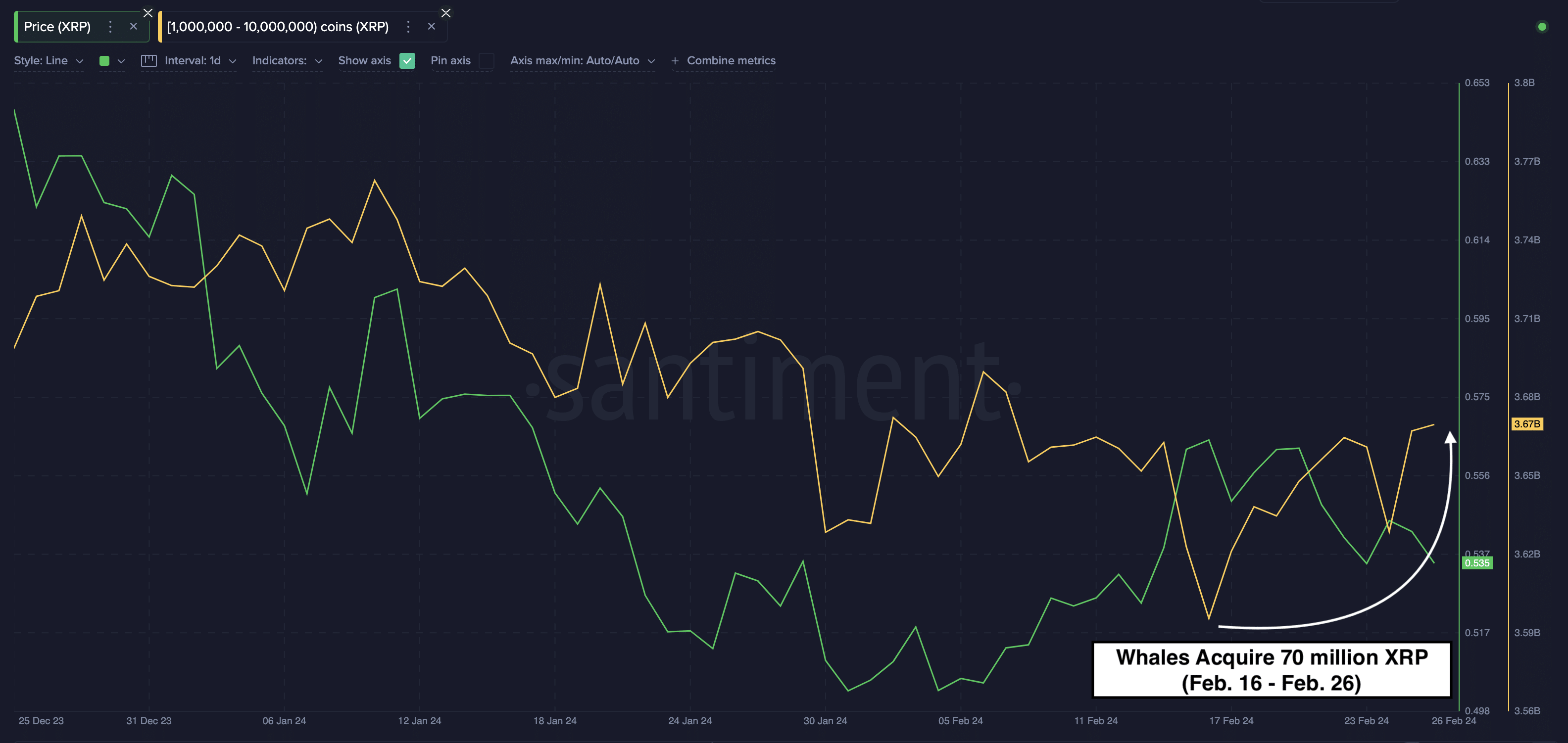

Crypto whales acquired 70 million XRP amid price dip

XRP price has tumbled 8.3% in the last 10 days, but in an unusual turn of events, a strategic cohort of price-savvy crypto whales have been spotted buying the dip aggressively.

Santiment’s chart below depicts real-time changes in balances held by wallets with 1 million to 10 million XRP coins. When the price declined at the local peak of $0.58 on Feb. 16, the whales held a total of 3.59 billion XRP in their cumulative balances. As of Feb. 26, they have added 70 million coins, bringing their balances to 3.66 billion XRP.

Valued at the XRP’s 10-day Simple Moving Average price of $0.55, it implies that the whales have spent approximately $38.5 million buying the dip between Feb. 16 and Feb. 26.

Heading into March 2024, the whale’s buying pressure could have a positive impact on XRP price for a number of reasons. Firstly, whale’s influence could incentivize retail investors to take on a bullish disposition, resulting in a significant market demand boost.

More importantly, historically, the buying trends of the particular whale cohort have often preceded past XRP price rallies. Hence, a repeat could trigger a significant price upswing.

XRP price forecast: $0.57 remains a major resistance

Drawing data-driven inferences from the recent market trends, XRP price appears more likely to enter an upswing toward $0.60 than a downswing below $0.50 in early days March 2024.

However, the Parabolic Stop and Reverse (SAR) technical indicator identifies the $0.57 area as the major short-term price resistance for XRP bulls. If the bulls can state a decisive breakout above the area, a $0.60 retest could be on the cards.

On the downside, the bears could invalidate this bullish XRP price forecast by forcing a downswing below $0.50 psychological support. But with crypto whales currently buying the dip, this scenario seems unlikely in the short-term.