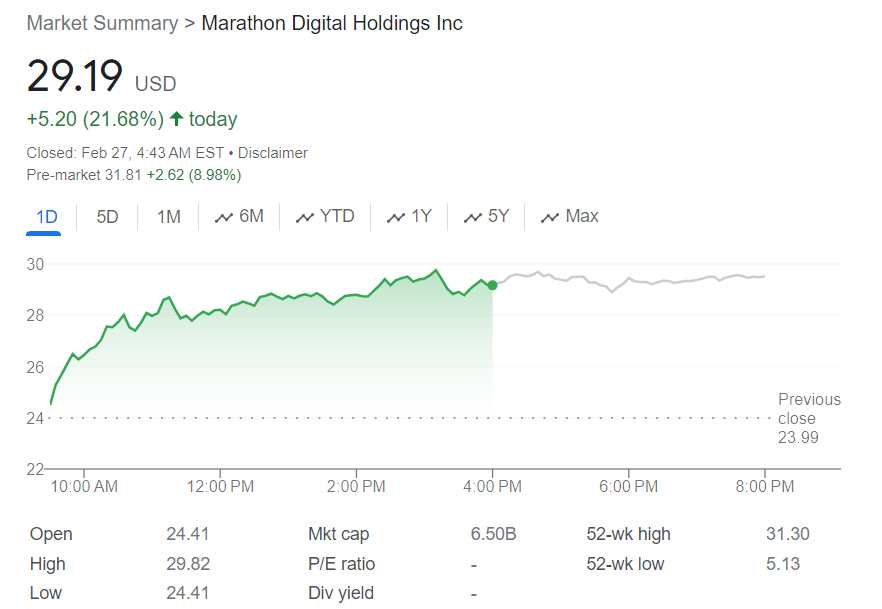

Marathon’s shares surged by more than 20%, fueled by investor optimism ahead of the forthcoming earnings report.

Anticipation surrounding Marathon‘s financial performance, particularly in the wake of Bitcoin’s recent price surge, has fueled significant investor interest. The bullish sentiment was evident as Marathon’s stock (MARA) on Nasdaq surged by 21% to $29 as of Feb. 27, according to data from Google Finance.

Analysts from Zacks Investment Research are forecasting Q4 revenues to reach $138.2 million, reflecting a staggering increase of over 100% compared to the same period last year, with a remarkable 385% year-over-year growth.

“Marathon Digital’s performance in the quarter is expected to have been positively impacted by an increase in bitcoin production and higher Bitcoin prices on a year-over-year basis.”

Zacks Investment Research

According to Seeking Alpha analyst Thomas Potter, the upcoming earnings call holds significant importance as it will provide insights into whether the company can maintain or enhance its financial position. The consensus estimate for MARA’s bottom line stands at $0.05 per share, according to Zacks.

Furthermore, the forthcoming report is anticipated to underscore Marathon’s readiness for the upcoming halving event, which will reduce Bitcoin mining rewards by half, from 6.25 BTC to 3.125 BTC.

Bitcoin halving occurs approximately every four years, specifically every 210,000 blocks. This mechanism is intrinsic to Bitcoin’s design to combat inflation and preserve its value over time. During the halving, the reward for mining new blocks is cut in half, reducing the rate at which new Bitcoins are created and, consequently, the total supply of BTC in circulation.