Grayscale, the world’s largest crypto asset manager, has seen nearly a third of its Bitcoin holdings withdrawn since converting its Bitcoin Trust (GBTC) into an ETF on Jan. 10.

As of March 4, GBTC witnessed its 36th consecutive day of outflows, with 5,450 BTC, equivalent to $368 million, exiting the trust. This brings the total outflow since the conversion to an astounding $9.26 billion, BitMEX Research reports.

Prior to its conversion into an ETF, Grayscale’s holdings were estimated at approximately 620,000 BTC, according to Coinglass. The conversion allowed investors the new ability to redeem their shares for Bitcoin, a move not possible under the trust’s previous structure. However, GBTC’s relatively higher fees compared to other ETFs, such as BlackRock’s IBIT and Fidelity’s FBTC, have contributed to the ongoing outflows.

Currently, GBTC’s holdings stand at 420,682 BTC, valued at an estimated $28.5 billion.

The market has been closely monitoring the situation, trying to predict when the outflows, often referred to as the “Bitcoin bleed,” might cease. Some slowdown in the outflows was noted in late January and February, leading analysts to suggest an impending end. Nonetheless, the scenario changed mid-February when bankruptcy courts permitted the crypto lender Genesis to liquidate about $1.6 billion worth of GBTC shares, aiming to reimburse investors.

Speculations about the end of the bleed vary, with Bloomberg ETF analyst Eric Balchunas previously estimating it would halt after a 25% share reduction. A poll on X indicated many expected it to occur between a 35-50% range.

Amid these developments, Grayscale has been advocating for the SEC to approve options on spot Bitcoin ETFs, arguing it would benefit GBTC investors and others in similar products by offering new ways to generate income and hedge financial positions.

Michael Sonnenshein, CEO of Grayscale, emphasized the importance of approving options for spot BTC ETFs, highlighting the potential for bringing additional stakeholders into the market and exposing spot Bitcoin ETFs to new investor classes and capital.

The performance of other spot Bitcoin ETFs has been noteworthy amidst a sustained Bitcoin rally. On March 4, these ETFs saw their second-largest volume day, with approximately $5.5 billion traded. The BlackRock IBIT fund alone reported around $2.4 billion in daily volume, with its assets under management surpassing $11 billion.

Furthermore, Fidelity reported a record day for inflows on the same date, with $404.6 million entering the fund, offsetting the outflows from GBTC. The Bitwise Bitcoin ETF (BITB) also saw significant interest, with $91 million in inflows, marking its highest since Feb. 15.

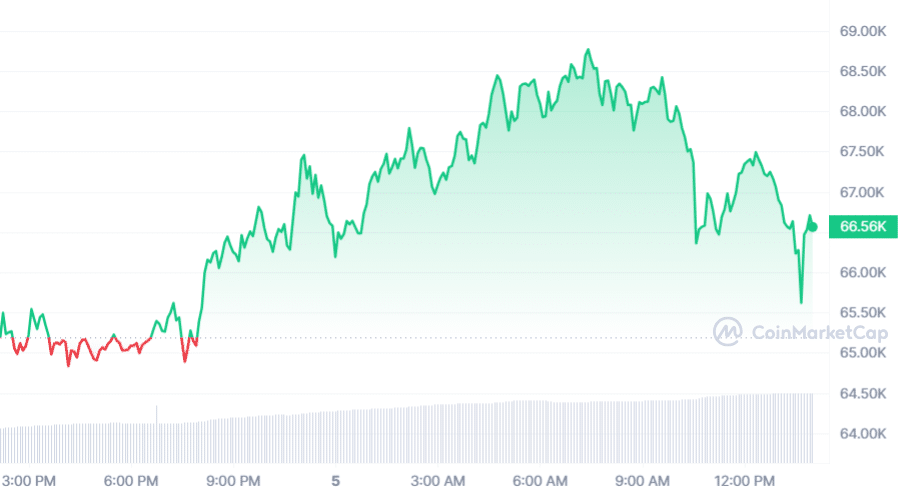

This surge in spot Bitcoin ETFs has contributed to an increase in Bitcoin’s price, which saw a 9% rise on March 4, nearing its all-time high of $68,789 recorded in November 2021.

The rise in Bitcoin’s price has also positively affected other cryptocurrencies, with notable increases in meme coins such as Dogecoin (DOGE) and Shiba Inu (SHIB) coin.