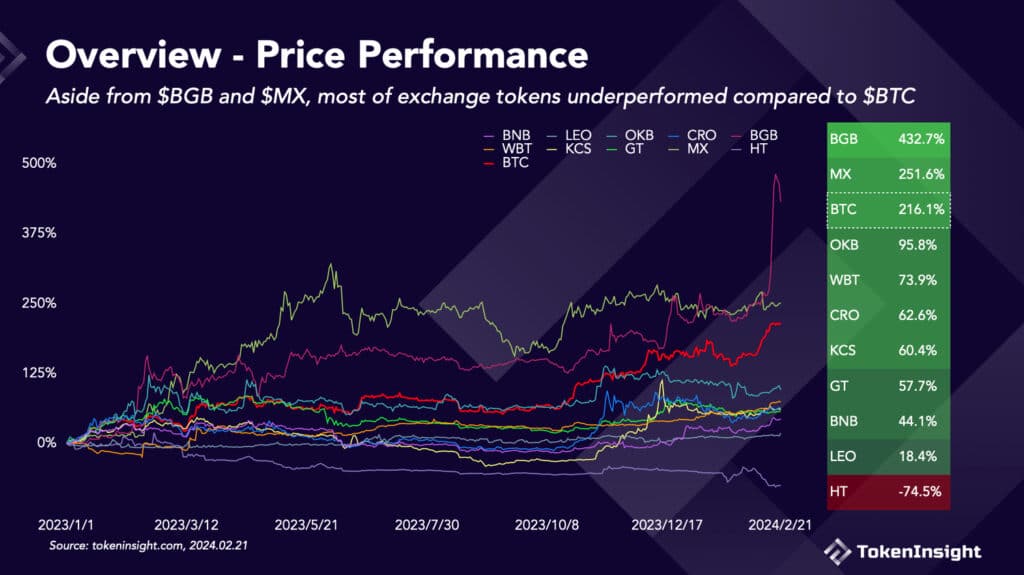

According to a study done by TokenInsight, most exchange tokens underperformed compared to Bitcoin performance.

Despite the growing popularity of crypto exchange tokens like Binance Coin (BNB) and Bitget Token (BGB), particularly amid the rise of decentralized finance and non-fungible tokens, Bitcoin (BTC) has proven to be a superior investment choice, analysts at TokenInsight revealed in a recent research report. Yet, not all tokens demonstrate the same level of profitability, with some facing side effects due to regulatory pressure.

“Affected by regulations, BNB experienced a significant decline in the second half of 2023; However, it rebounded towards the end and surpassed last year’s all-time high at the beginning of 2024.”

TokenInsight

According to the document, crypto exchange tokens collectively held a market cap of $68 billion as of February, accounting for 3.2% of the entire crypto market cap. However, this represents a slight decrease of approximately 0.3% compared to the end of 2023.

With Bitcoin’s dominance in the market remaining evident, some crypto exchange tokens like BGB and MX Token (MX) still managed to outperform it, witnessing gains of 434% and 248% respectively, TokenInsight’s data indicates. For comparison, Bitcoin soared by over 200% starting from early 2023, as per the report. Analysts added that HTX’s HT and OKX’s OKB tokens are the “only two tokens whose market value has fallen, falling by 75% and 53% respectively from the beginning of 2023.”