Michael Saylor’s MicroStrategy has an unrealized profit of over $8 billion as Bitcoin (BTC) consistently reaches new all-time highs.

According to data from Saylor Tracker, MicroStrategy has accumulated a total of 205,000 Bitcoins — costing the firm around $6.95 billion — since 2020 at an average price of $33,928 in 36 different dates and transactions.

The company’s BTC holdings are currently at a 117.3% profit — roughly $8.16 billion — at the time of writing, per the data provider.

Notably, MicroStrategy’s latest BTC purchase of 12,000 coins was completed on March 11 at an average price of $68,477. Per Saylor Tracker’s data, MicroStrategy’s Bitcoin holdings are currently worth $15.12 billion.

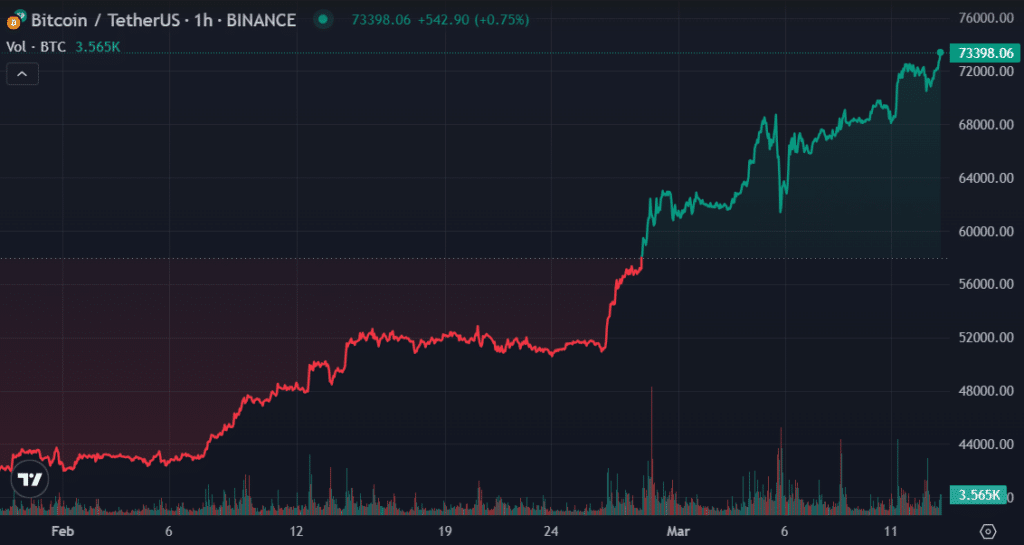

Bitcoin hits new ATH

The surge in MicroStrategy’s profits comes as Bitcoin has been consistently reaching new milestones over the past week.

BTC is up by 2.6% in the past 24 hours and is trading at $73,580 at the time of writing. It’s important to note that the flagship digital currency touched a new ATH of $73,610 at around 08:30 UTC on March 13 before slightly slipping.

Moreover, Bitcoin’s market cap is hovering at $1.44 trillion with a market dominance of 49.7%. The asset’s daily trading volume also increased by 11%, currently standing at $63 billion.