Researchers at CoinGecko say 42% of loans from private credit protocols focus on emerging markets, particularly in the automotive sector.

Private credit protocols — like Centrifuge and Goldfinch — allocate over 42% of their outstanding loans to a car financing, CoinGecko has revealed in a recent research report, adding that the sum is totaling more than $196 million in active loans. The surge in auto loans, which reached over $168 million across 60 loans in the past year, is primarily driven by borrowers mainly located in emerging markets like Africa, Southeast Asia, Central America, and South America.

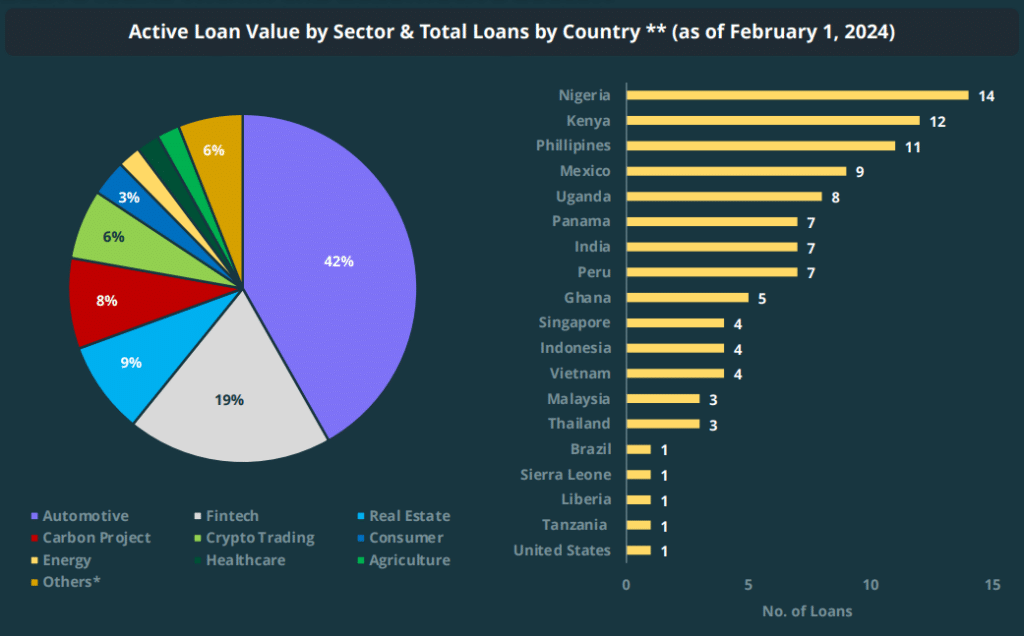

According to CoinGecko, the growth in the automotive loan sector has surpassed that of fintech and real estate debts, which now only comprise 19% and 9%, respectively. Analysts noted that out of 840 loans extended to the real estate and crypto trading sectors, only 10% remain active, with most either repaid or defaulted.

“The crypto trading sector alone saw 13 loan defaults in the wake of the Terra/Three Arrows Capital collapse.” CoinGecko

Data compiled by CoinGecko indicates that Nigeria leads in active loans by value, with 14 active loans as of Feb. 1, followed by Kenya with 12 active loans and the Philippines with 11 active loans. In total, over 40 loans originate from Africa, constituting 40.8% of the 103 accounted loans. These loans mainly target small and medium-sized enterprises, carbon projects, automotive projects, fintech, and consumer loans.