Tokenized treasures have grown by over 700% in one year. Learn how these digital assets are reshaping the investment scenes.

The concept of digitizing traditional financial assets like government or corporate bonds for trading on blockchain platforms has transitioned from theory to practice.

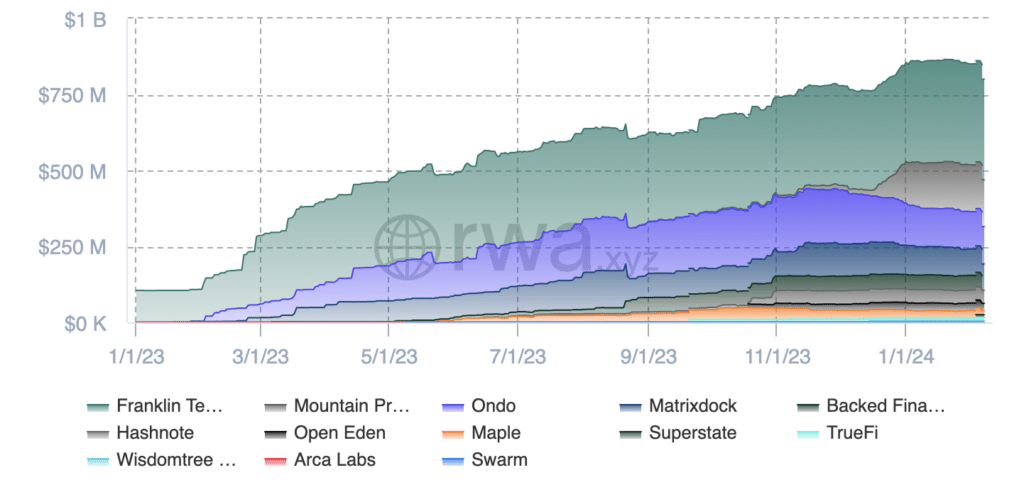

As of February, tokenized treasuries have emerged as a new avenue for crypto investors, with the market witnessing a growth of over 700%, reaching $860 million, up from $100 million at the start of 2023.

The surge in interest isn’t just from individual enthusiasts; institutional investors are also getting on board, recognizing the potential for higher yields and more diversified portfolios.

Global X, a giant in the world of exchange-traded funds (ETFs) managing over $42 billion in assets, predicts, based on the RWA.xyz data, that the market for tokenized bonds, which is currently under $1 billion, could explode to around $1 trillion by 2030, marking over a 1000x increase from current levels.

What are tokenized treasuries, and how do they work?

In essence, tokenized treasuries are a subset of tokenized securities, focusing solely on government debt instruments. What are tokenized securities? They are digital representations of traditional financial assets traded on blockchain networks using digital tokens. These tokens, essentially digital certificates, symbolize ownership or value of the underlying asset. Examples of tokenized securities include company stocks, government or corporate bonds, and even real estate properties.

In simple terms, imagine owning shares of a company, but instead of receiving a paper certificate or dealing with a brokerage firm, you have digital tokens stored securely in a digital wallet on your computer or smartphone.

Tokenized treasuries refer to government treasury securities, such as bonds or bills, that have undergone this tokenization process. The fundamental distinction between tokenized treasuries and their traditional counterparts lies in their execution and management.

Traditional treasuries can be cumbersome for investors, involving complex processes like converting local currency to U.S. dollars, navigating international brokerage services, and dealing with high fees.

Additionally, traditional treasuries require manual management of trading strategies, such as acquiring the latest Treasury issuances.

In contrast, tokenized treasuries leverage smart contracts on blockchain platforms to automate various processes, including issuance, trading, and redemption of securities.

This automation not only simplifies operations but also enhances security and transparency, as every transaction is recorded in an immutable and transparent manner.

Why are tokenized treasuries gaining traction?

The increasing prominence of tokenized treasuries can be attributed to several key factors.

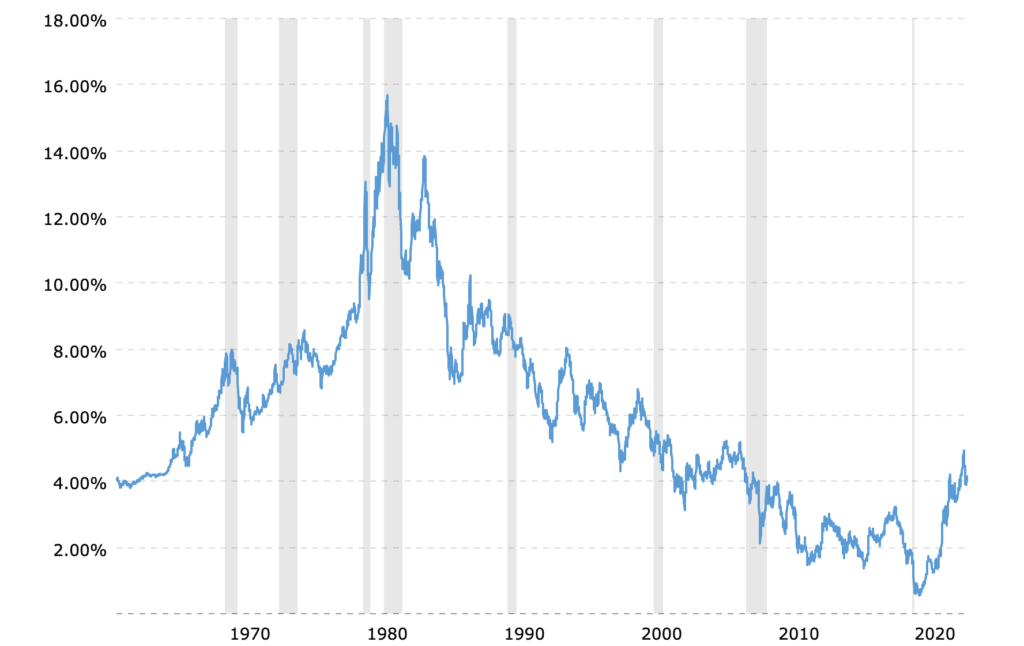

First, with tokenized treasuries currently promising an average yield of 5.25%, they stand out against the backdrop of traditional treasury yields, which have averaged 3.87% over the last decade. This disparity gets even deeper, especially when considering the historic low of 0.6% in 2020 for traditional treasuries.

Secondly, they offer enhanced liquidity, enabling fractional ownership and expanding the participation base. This means that investors can own portions of a treasury bill, making it accessible to individuals who may not have the capital to invest in an entire bill outright.

Moreover, the global accessibility facilitated by blockchain allows investors worldwide to easily participate in the U.S. treasury market without the need for intermediaries or the complexities associated with cross-border transactions.

Tokenized treasuries can also be employed as collateral in decentralized finance (defi) platforms. In this context, they serve as assets that users pledge to obtain loans or engage in various financial activities within the defi ecosystem.

Using tokenized treasuries enhances individuals’ access to liquidity and enables them to explore a broader range of financial opportunities.

However, several challenges exist, including security concerns, scalability issues, and the necessity for widespread adoption. These hurdles must be addressed for tokenized treasuries to realize their full potential.

Tokenized treasury trends across the globe

The tokenization of treasuries is becoming a notable global trend, with countries across different continents actively exploring this new financial instrument.

For example, the Philippines, for the first time, with its Bureau of the Treasury, opted for a tokenized approach over traditional auctions for its treasury bonds in Nov. 2023. Similarly, other Asian countries are making strides in tokenized asset adoption.

Hong Kong’s issuance of tokenized green bonds and Singapore’s collaborative pilots with financial firms for tokenizing real-world assets highlight the region’s proactive stance in embracing blockchain innovations.

The UAE and Israel are also on the map, with initiatives to tokenize bonds, indicating an acknowledgment of the benefits blockchain could bring to traditional treasury operations.

Tokenization race: leading providers and platforms

Leading the charge among tokenized treasury providers is Franklin Templeton Benji Investments, holding a substantial 38.4% of the market with $330.56 million.

Following closely is Mountain Protocol, capturing 17.6% with $151.2 million, and Ondo securing 12.4% with $107.13 million.

These top entities together amass over 68% of the market, leaving the remaining share of approximately 32% to be split among other competitors.

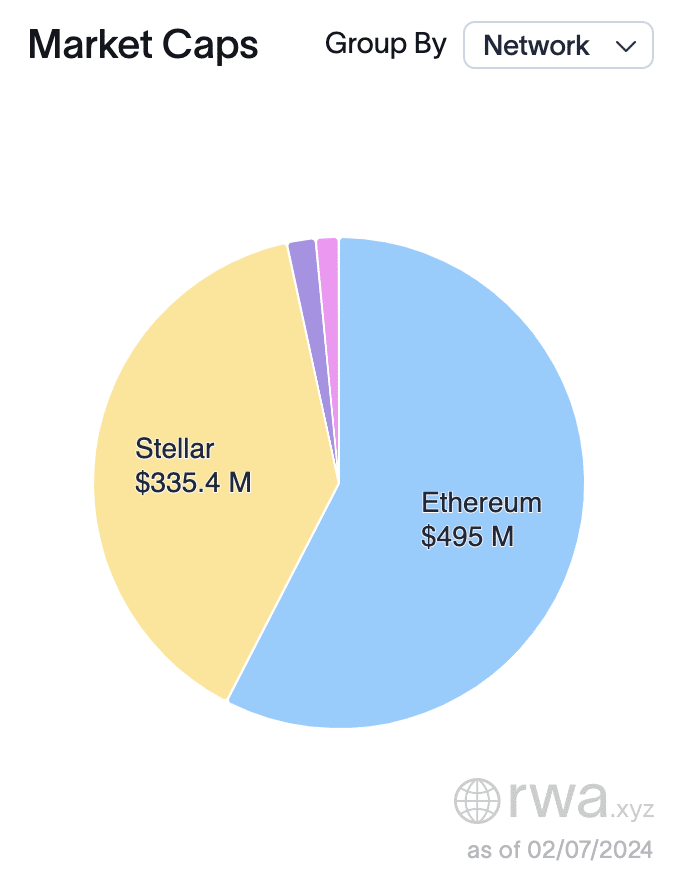

Meanwhile, the blockchain platforms hosting these tokenized assets reveal a clear preference for established networks.

Ethereum (ETH) stands out as the predominant platform, hosting 57.6% of the total market cap with $495 million in assets. Stellar (XLM) follows as a strong contender, supporting 39.1% of the market with $336 million.

Meanwhile, emerging platforms like Polygon (MATIC) and Solana (SOL) make a modest entry, holding $1.62 million and $1.30 million, respectively, indicating their growing influence in this space.

As the market evolves, these providers and blockchain platforms could likely shape the trajectory of tokenized asset management, blending crypto with the traditional finance world.