SOL price broke above the $100 milestone on Feb. 8; recent growth trends in Solana Total Value Locked (TVL) suggest more gains could follow.

Solana recorded dramatic growth with its defi ecosystem over the past week, even causing a brief network outage.

On-chain data analysis highlights how rapid capital inflows and rising network participation rate could propel SOL prices further up the charts in the coming days.

Solana’s price reclaims $100 after dramatic week

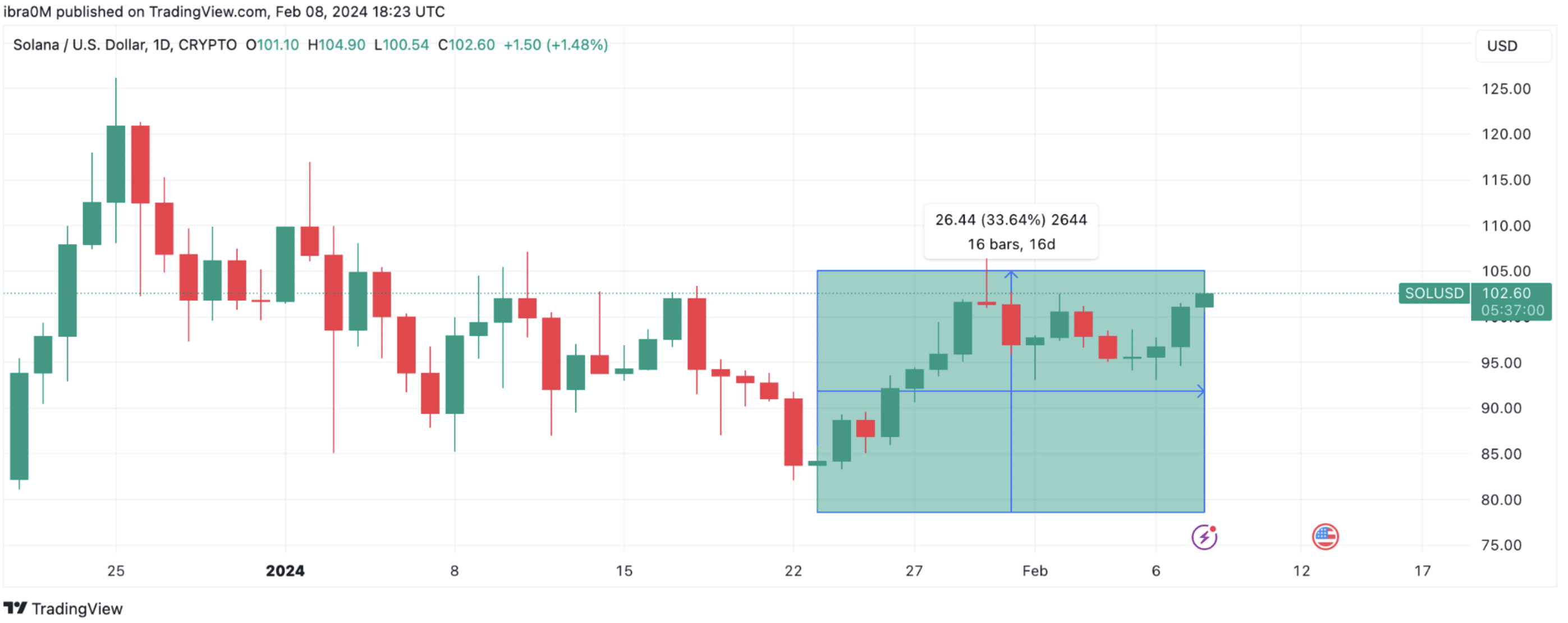

Solana has been the subject of major controversy and volatility in recent weeks. SOL prices ended January strongly with a blistering 35% upswing from $79 to $105 between Jan. 23 and Jan. 31, thanks to rising defi activity.

Things turned negative when the Solana blockchain network experienced a five-hour outage on Feb. 6, triggering negative market sentiment.

Rather than enter a panic sell-off, bullish SOL holders held their positions, and on Feb. 8, SOL price made another leg-up, hitting the $105 mark at noon Eastern time.

On-chain data trends show the 33.6% price rally over the last 16 trading days could be attributed to Solana’s defi ecosystem attracting millions of dollars worth of capital inflows.

Solana TVL hits 20-month peak

On Feb. 8, TVL on Solana’s defi ecosystem crossed the $1.8 billion mark for the first time since June 2022. As per DefiLlama data, it has grown by $500 million in the last 16 days, dating back to Jan. 23.

This milestone came from projects built on the Solana layer-1 network that have made giant strides in attracting investor attention in recent weeks.

While the Jupiter (JUP) decentralized exchange airdrop has arguably gained the most media notoriety, Jito, Kamino, and Blazestake have received the highest capital inflows over the past month.

When a layer-1 blockchain network receives a boost in TVL, as currently observed on Solana, it strongly indicates growing investor interest in its native projects.

As the users of those projects begin to carry out their desired network transactions, ranging from liquidity staking and lending to DEX trading, it elicits increased market demand for the native SOL token and ultimately drives up the price.

SOL price forecast: Clear coast to $120?

Based on the data trends analyzed above, the organic $500 million increase in TVL has been pivotal in driving SOL’s 33.6% price rally between Jan. 23 and Feb. 8.

With the TVL still trending upwards, SOL could be in line for further price gains, possibly retesting the $120 coveted territory in the days ahead.

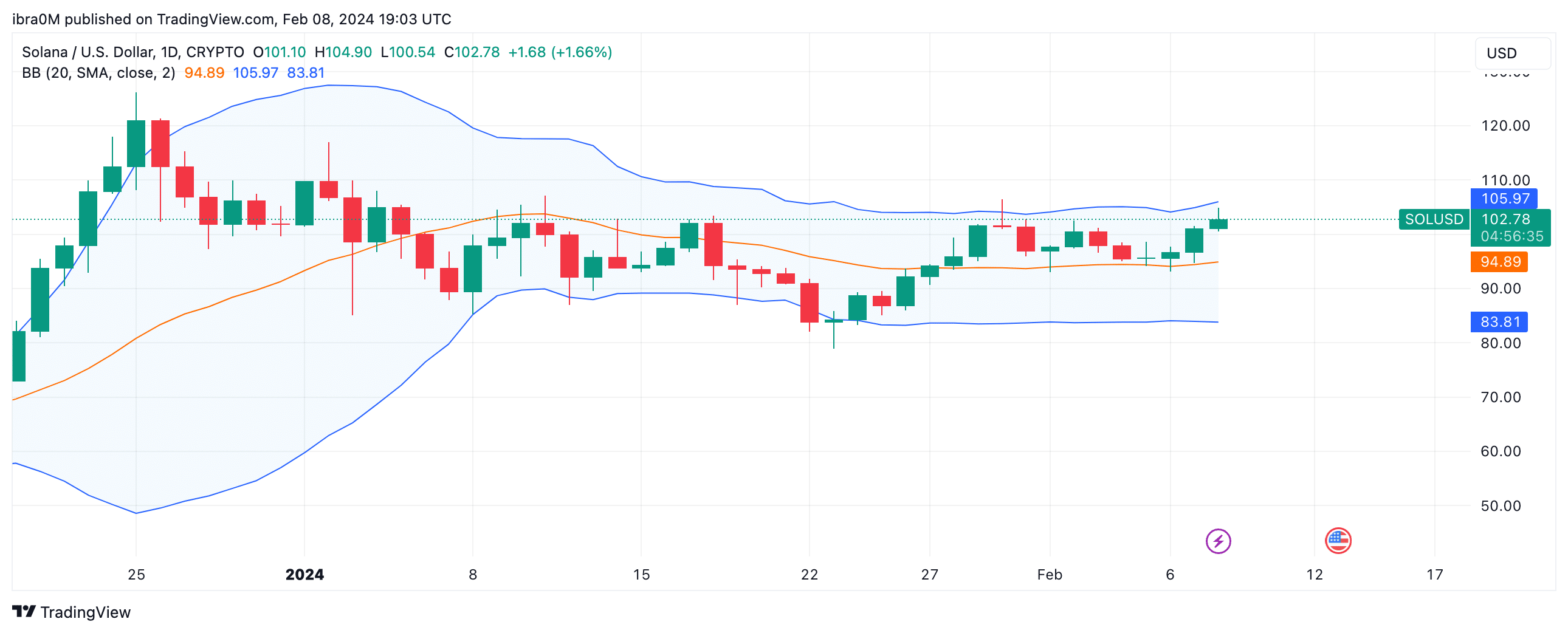

Regarding key resistance points to watch, the upper Bollinger band technical indicator highlights that the bears could mount a sell-wall around the previous local top at $105.

If the bulls can stage a decisive breakout above the area, an audacious move toward $120 territory could be on the cards.

Conversely, the bears can invalidate this optimistic price prediction if they force a downswing below $80. But that seems far-fetched, with the lower Bollinger band indicator pointing towards a looming support buy-wall at $83.

If the bulls can hold that support level, they could trigger another rebound phase.