Bitcoin (BTC) has surpassed the $50,000 mark for the first time since December 2021 on its way to an all-time-high. Following the bullish sentiment, the broader crypto market surged as well.

Bitcoin is up by 3.9% in the past 24 hours and is trading at $50,050 at the time of writing. The flagship crypto asset’s market cap is getting close to the $1 trillion mark — currently standing at $982 billion.

The daily trading volume of BTC also surged by 105%, reaching $39 billion.

Following Bitcoin’s price rally, the global crypto market cap increased by 4.2% and currently hovering around $1.96 trillion, according to CoinGecko. Notably, Bitcoin’s dominance declined from 52% to 50% over the past day, per the price aggregator.

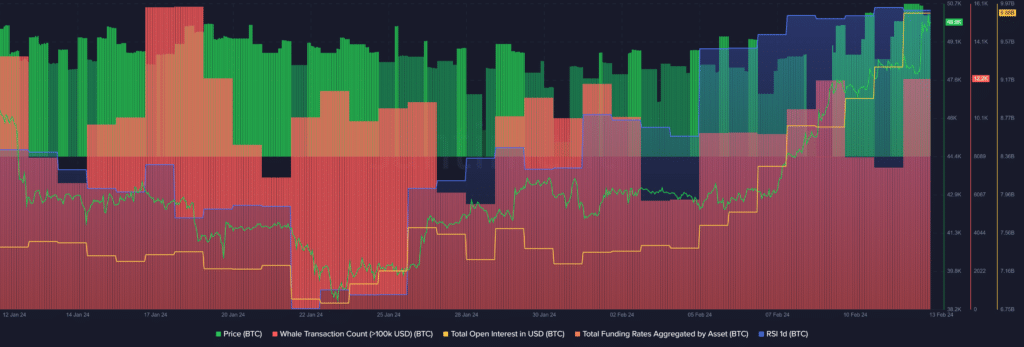

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of BTC increased from 7,510 to 12,206 unique daily transactions over the past 24 hours.

When an asset’s whale activity suddenly rises, high volatility is usually expected.

Santiment data shows that Bitcoin’s Relative Strength Index (RSI) is currently hovering around 84. The indicator suggests that the BTC price could soon face rejection and a decline below the $50,000 mark is very likely.

For Bitcoin to stay in the bullish zone, its RSI would need to cool down below the 65 mark at least.

According to the market intelligence platform, the Bitcoin total open interest (OI) surged from $9.3 billion to $9.8 billion in the past 24 hours. Moreover, the total funding rate aggregated by BTC is currently standing at 0.01%, suggesting that long-position holders are slightly dominating short traders until further price movements.

Furthermore, a recent report revealed that spot BTC ETFs accumulated over $2.8 billion in net assets despite Grayscale’s large withdrawals.

Santiment data shows that 53% of the conversations on social media show positive sentiment toward Bitcoin while nearly 40% are pessimistic despite the bullish momentum.