Solana’s price reached a 2024 peak of $186 on March 15, and key on-chain data trends highlight how Dogwifhat’s 400% rally has impacted SOL’s market demand.

SOL’s price held firmly about the $175 support after a 5% pullback from the 2024 peak of $186 on March 15. Solana’s on-chain data reveals a vital connection with its native memecoins Dogwifhat (WIF) and BONK, which could propel SOL price toward $200 in the coming weeks.

Why is Solana’s price going up?

Solana’s price is up 60% this month, with global demand for meme tokens emerging as a major bullish catalyst.

Leading Solana-hosted meme tokens, WIF and BONK, are at the forefront of the memecoin rally, which appears to have triggered increased market demand for SOL.

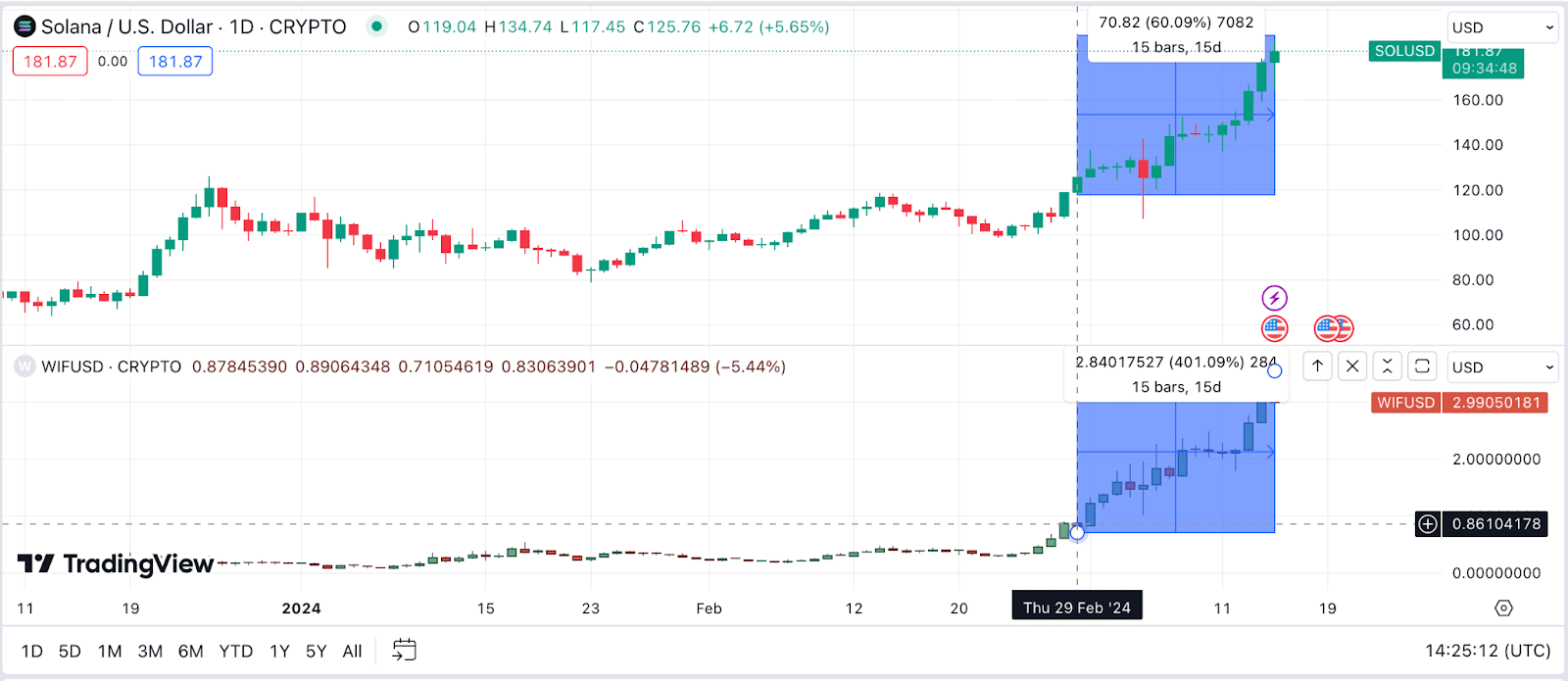

As seen above, the SOL price had delivered a relatively flat performance in the first two months of 2024. Between Jan. 1 and Feb. 29, SOL largely traded within the $100 to $110 range.

However, the market momentum flipped bullish in early March as the global memecoin rave spread towards the Solana network. Since March, SOL’s price has increased by 60%, mirroring WIF’s 401% rally.

Solana hits record-high of 816k new users amid memecoin mania

Looking beyond the price charts, other vital on-chain metrics show how the memecoin mania has attracted new users to the network while also increasing SOL mindshare among investors.

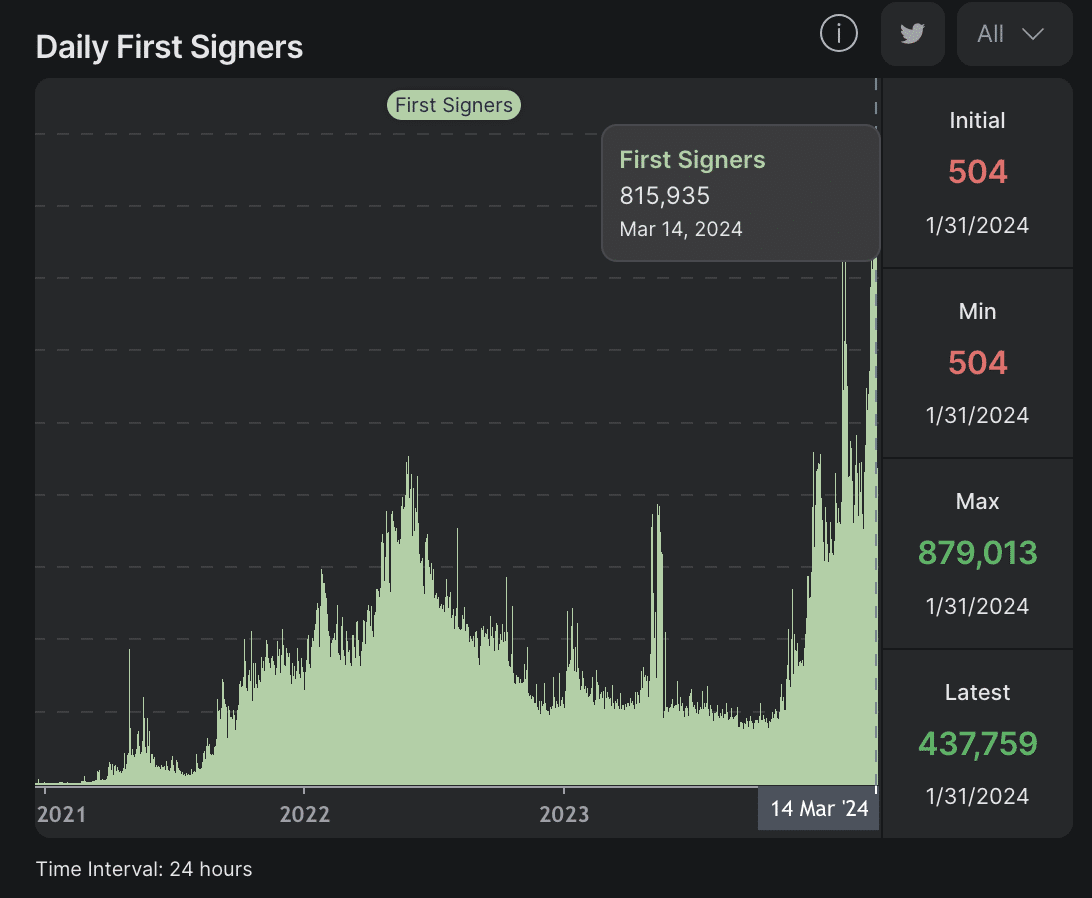

HelloMoon’s daily first signers metric tracks the number of new addresses conducting first transactions on the Solana blockchain.

Since the latest WIF rally began in late February, the SOL network has witnessed an unusually high number of new users.

The latest figure of 815,935 new entrants registered for March 14 is the second-highest ever, just 7% shy of the all-time high of 879,013 recorded on Jan. 31.

Since the start of March, Solana has pulled an average of 500,000 new addresses daily that are conducting their first transactions.

A prolonged period of rising new user transactions is a prime indication of new active investors bringing fresh capital inflows to the blockchain network. As those new entrants carry out network transactions, demand for the underlying native token increases.

Unsurprisingly, the price of SOL has increased by 60% during that period, peaking at $186 on March 15. With the memecoin rave still in play, SOL looks set for another leg-up in the weeks ahead.

Solana’s price forecast: Can SOL reach $200 in 2024?

Drawing insights from the on-chain data analyzed above, new entrants into the WIF and BONK meme rallies have been a major catalyst behind SOL’s 60% price rally in the first half of March 2024.

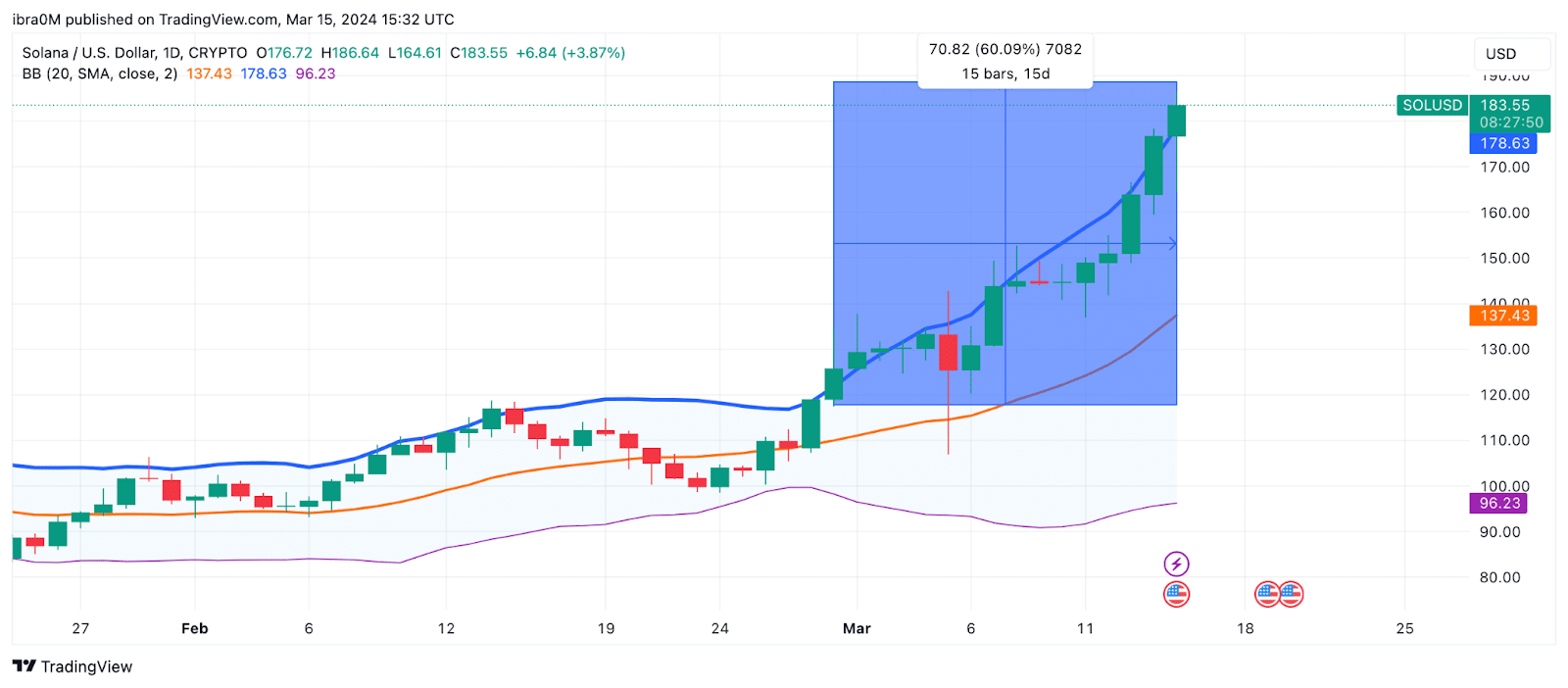

Regarding short-term price action, the Bollinger band technical indicators suggest that SOL could head towards the $200 milestone in the days ahead.

On March 15, SOL was trading at $182, significantly higher than the upper Bollinger band at $178. This rare market alignment occurs when the trading momentum for an asset becomes overwhelmingly bullish.

Considering that SOL has previously breached the $185 resistance within the last 24 hours, the bulls could now set their sights on higher targets closer to $200 during the next rally.

But in a bearish downswing, the bulls can mount a support buy-wall around the 20-day simple moving average price at $173.

However, strategic investors could be cautious as new users and increased transactions raise the risk of another network outage.