Chainlink, the biggest blockchain oracle network in crypto, has overthrown Dogecoin (DOGE) as the 11th-largest cryptocurrency on the market.

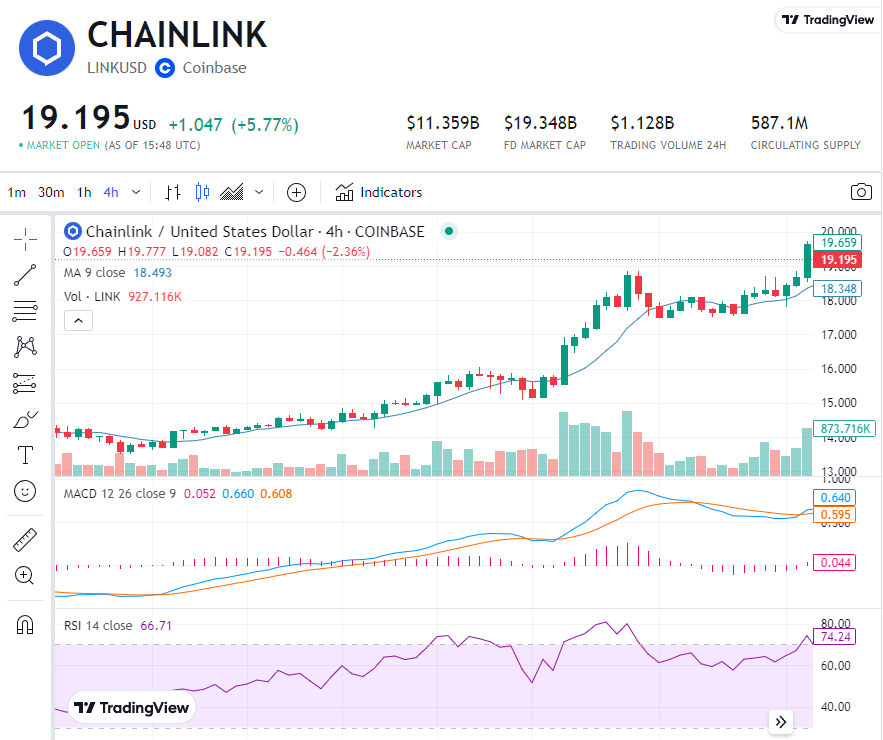

LINK has risen by over 6% today and 34% in a week, becoming the highest gainer in the market today. As part of the price increase, LINK crossed the $19 mark today for the first time since FTX’s collapse in 2022.

There is also a notable correlation between the altcoin’s market movement and its trading volume, as LINK’s trading volume was boosted nearly 100% today, according to data from CoinMarketCap.

LINK’s market movements

From a technical perspective, LINK has broken out from a horizontal trading range that had been in place for nearly 90 days. This breakout ended an 85-day consolidation period below resistance, propelling the price to over $19.75, its highest in over two years.

LINK’s Relative Strength Index (RSI) is also significantly low, at 14, which suggests a further bullish momentum could be anticipated, followed by a period of corrections.

An RSI of 14 is considered to be highly oversold. The RSI is a momentum indicator used in technical analysis that measures the speed and change of price movements on a scale from 0 to 100. Typically, an RSI below 30 indicates that an asset is in oversold conditions, suggesting that it may be undervalued and could be due for a reversal or corrective rally as sellers may have exhausted their positions, leading to potential buying opportunities.

However, while an extremely low RSI can indicate the potential for a price increase, it is not a guarantee.

On the fundamental side, Chainlink has focused on significant upgrades and expansions into traditional finance (TradFi) and real-world assets (RWA). The launch of the Cross Chain Interoperability Protocol (CCIP) and the expansion of Chainlink Data Streams and Chainlink Functions aim to enhance the network’s utility and adoption across various chains and assets.

This strategic push towards integrating with the capital markets and bolstering transparency and efficiency in the valuation of underlying assets is likely contributing to the positive market response.