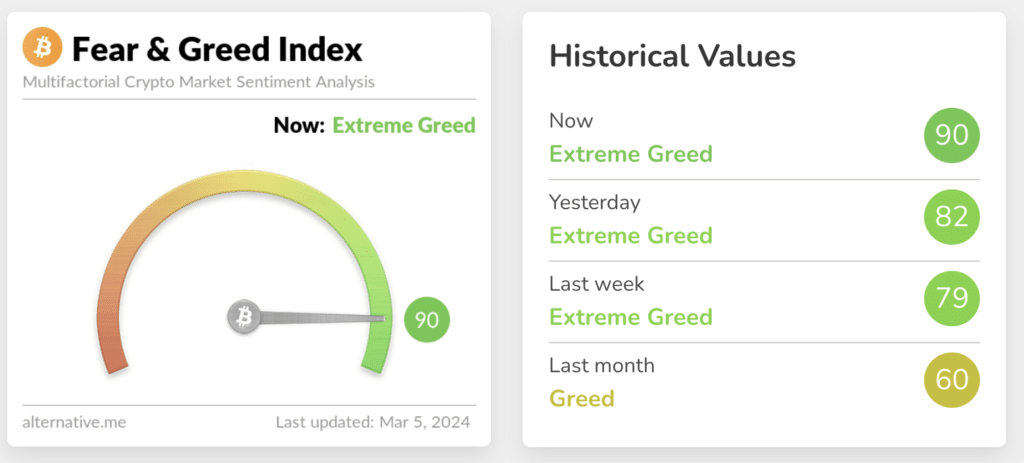

The Fear and Greed Index has reached its highest level since February 2021.

With Bitcoin (BTC) approaching an all-time high (ATH), the cryptocurrency Fear and Greed Index has reached 90,

The level of 75-100 shows an extreme level of greed and means that traders in the market are in the mood to buy more. When the market goes up, people tend to accumulate more cryptocurrency, which means they become more greedy, a phenomenon that leads to higher price movements.

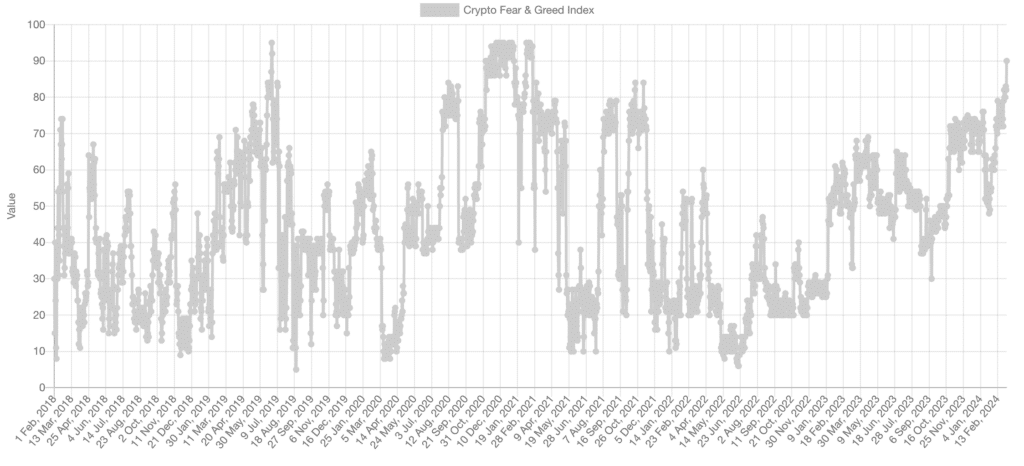

The graph shows that the metric has been below 70 for several years. Market sentiment has improved noticeably since last fall amid the market recovery and its transition to a bullish phase.

At the time of writing, BTC is trading at $66,700. Over the past 24 hours, the asset has risen in price by 2.4%; in 7 days, it has increased by 17.7%, according to CoinMarketCap. Bitcoin’s market capitalization has updated its all-time high above $1.3 trillion, and on March 4, the BTC price reached $68,600 – just below the all-time high recorded in November 2021.

Against this rise, the volume of liquidations on futures on the cryptocurrency market amounted to more than $560 million. Most liquidations occurred on trading pairs with Bitcoin, Ethereum (ETH), Dogecoin (DOGE), Shiba Inu (SHIB). The largest amount of liquidations has traditionally been recorded on the Binance and OKX cryptocurrency exchanges.