According to a report by Hacken, almost half of the crypto hacks in 2023 occurred due to access control issues.

The crypto market faced losses totaling $1.9 billion due to hacks in 2023, reflecting a significant 93.6% decline compared to 2022, primarily influenced by the Terra collapse, as per a research report from Hacken, a blockchain security auditor.

Despite this decrease, analysts express concern about the dynamics of 2023, emphasizing the quantity and nature of incidents. While the scale of attacks may appear smaller than in 2022, Hacken highlighted a 14% increase in attacks over the past year, identifying access control issues as the most damaging vulnerability in 2023.

“Unauthorized access to hot wallets by hackers or insiders accounted for half of all stolen funds, averaging $31 million per incident.”

Hacken

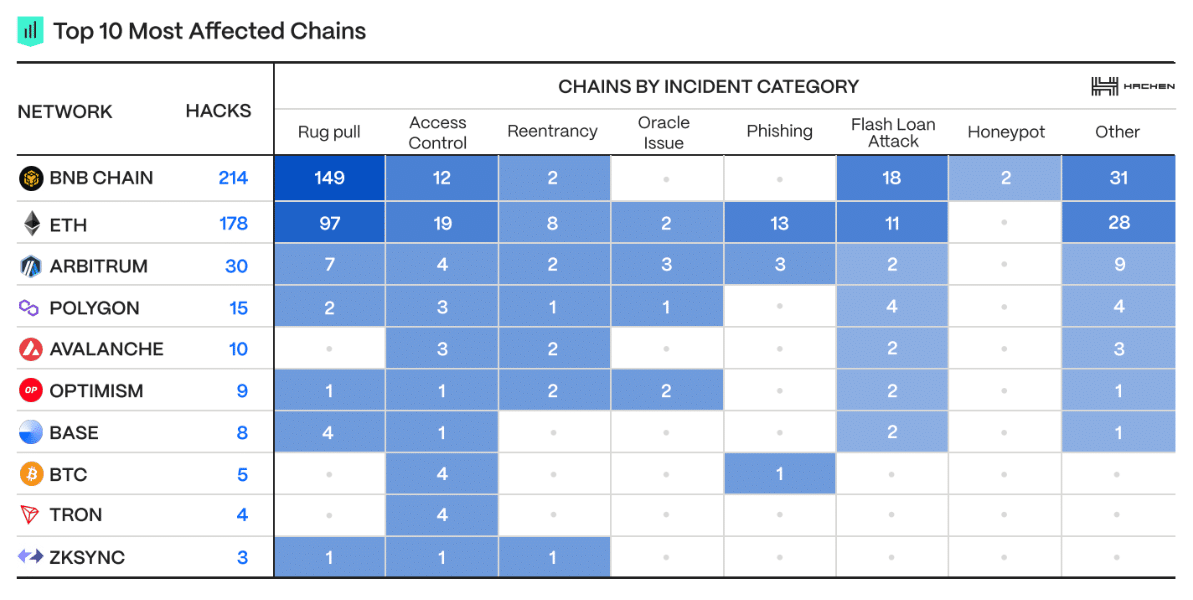

Other types of attacks, including rug pulls and flash loan attacks, still enriched hackers with hundreds of millions of dollars worth of crypto, as indicated by data compiled by Hacken.

BNB Chain (formerly Binance Smart Chain) emerged as the most targeted network by hackers in 2023, with 214 incidents recorded, followed by Ethereum (178 incidents) and Arbitrum (30 incidents). Analysts at Hacken suggest that these statistics may be attributed to blockchain developers who remain hesitant to audit their protocols.

According to the firm’s data, only 10% of exploited smart contracts underwent any form of audit in 2023, adding that “merely half of these were relevant.” Despite this, Hacken noted cases where protocol developers launched a different code in production than the one prepared for audits.

Nonetheless, 2023 appears to be the first year when exploited smart contracts successfully recovered around 20% of stolen funds (worth ~$400 million) thanks to rapid team responses and, surprisingly, the goodwill of hackers, Hacken concluded.