Explore the trends and sentiment within Polygon’s market, uncovering the factors influencing Polygon (MATIC) price prediction.

Polygon (MATIC), the largest layer-2 blockchain platform with a market capitalization of over $8 billion, has experienced significant fluctuations in its price since the beginning of 2024.

MATIC reached a monthly high of $0.955 on Jan. 11 as Bitcoin (BTC) spot ETFs received approval from the U.S. SEC, and market momentum turned positive.

However, amid ongoing volatility, MATIC’s price declined to $0.6933 on Jan. 23. As of Feb. 9, MATIC is trading at around $0.84.

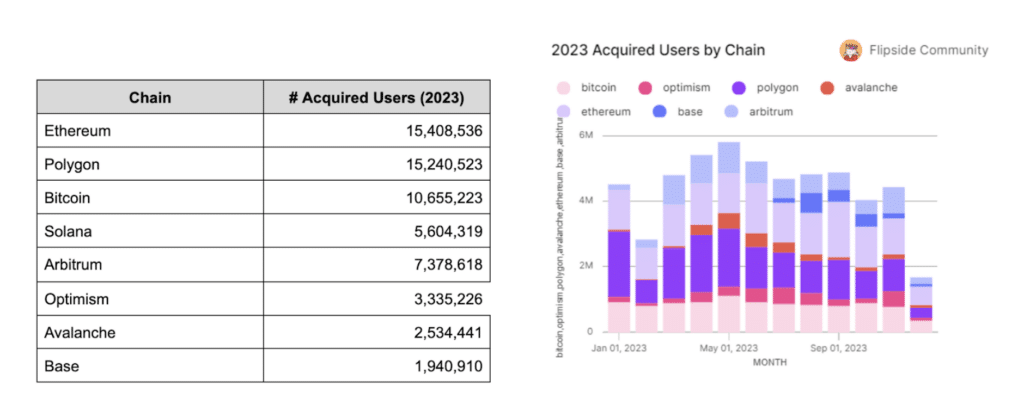

A recent finding reveals that in 2023, Polygon witnessed a substantial increase in user addresses, totaling 15.2 million, cementing its position as a leading blockchain platform after Ethereum (ETH).

Compared to Bitcoin, which acquired 10.6 million new user addresses in the same period, Polygon’s growth exceeded it by 50% in terms of user addresses.

Arbitrum (ARB), Optimism (OP), and Base also made notable appearances in the top eight projects for user growth, highlighting the emergence of layer-2 scaling projects as one of the fastest-growing sectors within the crypto industry.

Let’s delve deeper and explore the current ecosystem of Polygon to understand better how it impacts Polygon price prediction.

Introduction to AggLayer V1

Polygon plans to roll out AggLayer V1 in Feb. 2024. This introduction aims to bridge the gap between existing blockchain architectures.

Currently, the blockchain industry faces scalability, interoperability, and fragmented liquidity challenges. Traditional blockchain architectures can be broadly categorized into two types:

- Monolithic architectures: These are characterized by a single, integrated layer handling all blockchain operations, including transaction processing, consensus mechanisms, and data storage. While they offer simplicity and cohesive liquidity, they struggle with scalability and high transaction fees as the network grows.

- Modular architectures: These separate the various functions of a blockchain into distinct layers or modules, which can operate independently. This approach offers improved scalability and flexibility but often leads to fragmented liquidity and a disjointed user experience across different blockchain networks.

AggLayer V1 proposes a solution to these challenges by introducing an “aggregated” blockchain architecture.

This architecture aims to combine the strengths of monolithic and modular systems using ZK proofs, a type of cryptographic proof that allows one party to prove to another that a statement is true without revealing the statement itself.

Here’s how AggLayer intends to address the core issues:

- Interoperability: By aggregating ZK proofs from connected chains, AggLayer enables seamless cross-chain transactions, enhancing interoperability across the blockchain landscape.

- Scalability: AggLayer facilitates a unified liquidity pool and scalable transactions across different chains without compromising on security or sovereignty of individual blockchains.

- User experience: For end-users, AggLayer promises a smoother and more integrated experience, mitigating the need for complex bridging mechanisms between different chains.

AggLayer V1 is only the initial version. AggLayer v2, which is anticipated to support asynchronous cross-chain transactions, is expected to be released later this year.

Recent dapp developments and updates on Polygon

Polygon’s ecosystem has witnessed noticeable growth over the years, featuring several new dapps and updates aimed at improving utility and user experience.

As of Feb. 9, there are 980 active decentralized applications (dapps) on Polygon as per Alchemy, including some that operate across multiple chains.

One noteworthy development is the partnership between API3 and Polygon. API3 plans to launch a special chain using the Polygon Chain Development Kit (CDK), allowing dapps and users to benefit from oracle extractable value (OEV). OEV refers to the profit that oracles can earn from transactions due to their unique position as data sources.

The OEV Network aims to capture this value from all dApps utilizing API3 data feeds across various chains and redistribute it back to the protocols.

Sandeep Nailwal, the co-founder of Polygon, said in the announcement:

“The robust security and customizable nature of Polygon CDK encourages innovative use cases for teams that are hyper-focused on solving unique problems. API3 has always been at the forefront of unique problem solving, and the OEV network is a massive value unlock for builders across the ecosystem.”

Meanwhile, Fox Corporation released a beta version of Verify, an open-source protocol built on Polygon PoS. Verify is designed to address the challenges posed by AI-generated content, ensuring authenticity and trustworthiness in digital media. It enables publishers to register content, ensuring its origin is traceable through cryptographic signatures on-chain.

Initially launched during the Fox News GOP debate, Verify has already signed 89,000 pieces of content from various Fox sources. Now open-sourced, Verify invites public contributions and offers consumers a tool to verify content origins.

TVL performance and market dynamics

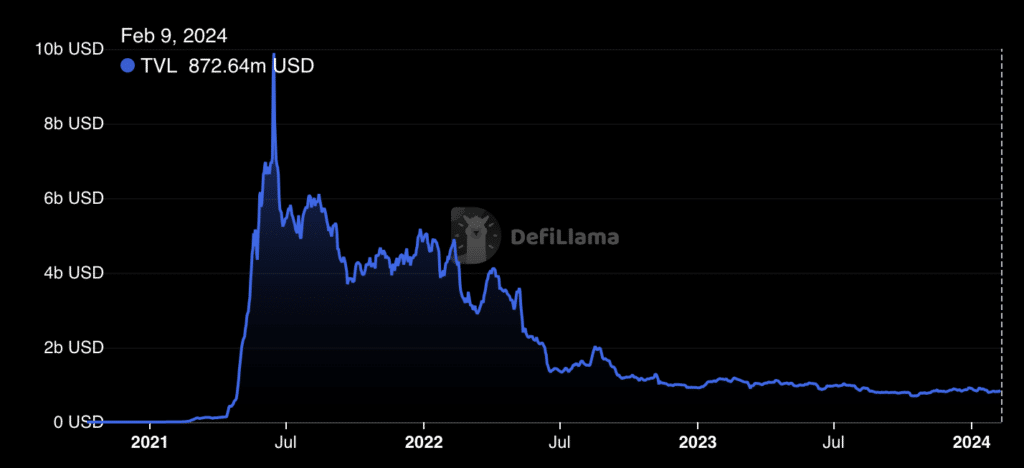

The total value locked (TVL) in the Polygon ecosystem has been fluctuating recently.

In Jan. 2024, Polygon recorded a TVL exceeding one billion dollars, marking its highest figure since at least early October 2022. However, as of Feb. 9, Polygon’s TVL has declined to around $872 million.

The trajectory of Polygon’s TVL may be influenced by factors such as increasing adoption and its role in the decentralized finance (defi) sector, particularly in light of its strategic pivot towards embracing zkEVM Validium L2 to strengthen its market positioning.

Furthermore, according to data from Token Terminal, Polygon ranks second in daily active users, with a figure surpassing 650,000, trailing behind Binance Chain (BNB), which boasts over 1.3 million active users.

Polygon (MATIC) price prediction: short-term view

Since May 2023, the crypto market has witnessed an approximate 100% uptrend, with MATIC being a notable exception, experiencing a 15% decline in the same timeframe.

A critical analysis revealed through a tweet indicates a 2-year bullish pennant pattern for MATIC, traditionally seen as a precursor to significant price movements.

This pattern suggests a potential 400% price increase post-breakout. Nonetheless, the MA 100 serves as a near-term resistance, with a rejection at this level possibly leading to extended consolidation within the pennant formation.

Meanwhile, CoinCodex (CC) offers a Polygon coin price prediction for Feb. 20, projecting a price of $1, which translates to a 21% increase from current levels.

However, remember that technical analysis and MATIC coin price predictions are not guaranteed outcomes. Always research and consider your financial situation and risk tolerance before investing in crypto assets.

Polygon (MATIC) price prediction: long-term view

Delving into the Polygon crypto price prediction across various timelines, projections suggest a dynamic future for MATIC.

2024

According to DigitalCoinPrice (DCP), the Polygon price prediction for 2024 is optimistically set at $1.81. This figure indicates a bullish outlook in the near term, underscoring a potential uptrend from current levels.

2025

As we extend our horizon to 2025, forecasts become more varied. CC presents a range between $0.833653 (low) and $3.34 (high), suggesting significant volatility and opportunity. Concurrently, DCP projects a more conservative estimate of $2.01 for the Polygon price prediction for 2025.

2030

Looking further ahead, the Polygon price prediction for 2030 diverges notably. CC anticipates a spectrum from $1.601698 to $6.92, while DCP offers a promising outlook with a projection of $5.93.

Keep in mind

- Cryptocurrency investments carry a high level of risk and can result in the loss of your entire investment. Always perform due diligence.

- Price predictions are speculative and should not be the sole basis for any investment decision.

- Market volatility is a constant in the crypto space, and external factors can dramatically impact price movements.

In conclusion, while Polygon’s price forecast offers exciting possibilities, investors should approach with caution, armed with research and an acute awareness of market risks.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

FAQs

Is Polygon (MATIC) a good investment?

Polygon (MATIC) has shown significant growth and utility within the blockchain ecosystem, especially with its upcoming AggLayer V1 launch and increasing dapp developments. However, investing in cryptocurrencies like MATIC involves high risk, and it’s crucial to do your research and consider your financial situation and risk tolerance before investing.

Will MATIC go up or down?

Recent trends suggest potential growth for MATIC, especially with positive developments like the bullish pennant pattern indicating a possible price increase. However, market volatility and external factors can impact prices unpredictably. It’s advisable to stay informed on market trends and perform thorough analysis before making investment decisions.

Should I invest in Polygon?

Investing in Polygon could offer potential returns, given its promising developments and strategic positioning in the defi sector. However, the crypto market is highly volatile, and investments can fluctuate widely. Always conduct comprehensive research, assess your risk tolerance, and consider seeking advice from financial experts before making investment decisions. Remember, you should never invest more than you can afford to lose.