Spot Bitcoin ETFs in the U.S. saw daily net outflows for the first time as Grayscale GBTC selloffs outpaced inflows into nine other funds.

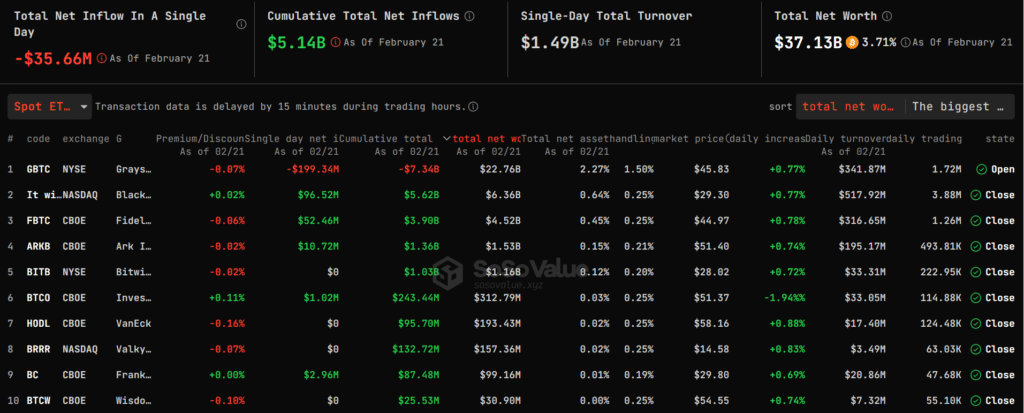

On Feb. 21, spot Bitcoin (BTC) ETFs recorded net outflows worth $35.6 million in what may be a round of profit-taking by investors. Yesterday was the first day these Bitcoin-based exchange-traded funds experienced negative numbers since Jan. 25, following 17 days of consecutive net inflows mainly led by BlackRock and Fidelity.

According to SoSoValue, Grayscale’s GBTC ETF accounted for the bulk outflows. GBTC shed $199 million, bringing total exits from the converted Grayscale Trust closer to $8 billion at press time. GBTC was still the largest spot Bitcoin ETF on the market, with $22.7 billion in assets under management (AUM).

BlackRock and Fidelity remain spot Bitcoin ETF leaders behind Grayscale, and both firms pulled inflows worth tens of millions despite GBTC exits. The issuers had $96.5 million and $52.4 million flow into their funds. These two combined boast over $10 billion in AUM and cumulative inflows, more than any other issuer excluding GBTC.

Experts: Spot Bitcoin ETFs great for price rallies

Bitcoin is seeing demand via institutional investment wrappers despite the first day of net outflows in about four weeks underpinned by GBTC redemptions. Nine issuers have accumulated over 250,000 BTC in less than a quarter, vaulting over incumbent Bitcoin holders like MicroStrategy and Tether.

Fundstrat co-founder and research chief, Thomas J. Lee, said these investment vehicles will continue to attract capital from retail investors and corporate equity alike. Lee explained that this sustained interest will most likely contribute to higher prices for Bitcoin.

Additionally, experts surmise the upcoming BTC halving, expected in April, will introduce a supply shock as Bitcoin rewards are slashed by 50% and scarcity is bolstered.