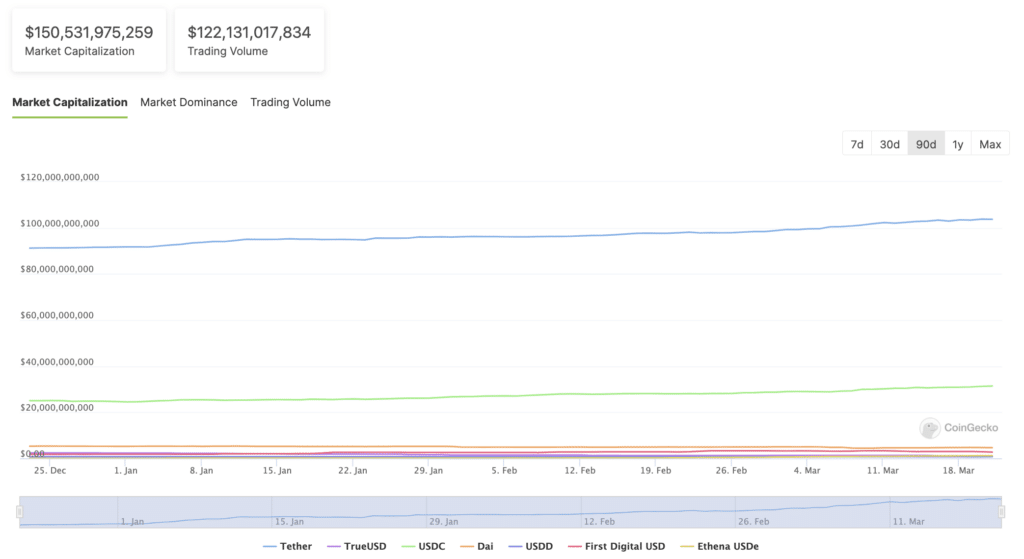

On March 21, the market capitalization of stablecoins reached $150 billion for the first time in 18 months.

According to CoinGecko, in addition to the growth of market capitalization to $150.5 billion, daily trading volume for the asset class approached $122 billion.

The undisputed leader in this category is Tether (USDT), which has 70% dominance. The second largest stablecoin, USD Coin (USDC), has a market capitalization of $31.8 billion, giving Circle‘s stablecoin a market share of over 20%. In third place is DAI, which had $4.7 billion and 3% of the market share at the time of writing.

The crypto community believes that the increase in stablecoins‘ market capitalization is an optimistic signal for further market growth.

In particular, stablecoins satisfy a market need if they have such a large market capitalization.

Earlier in March, rating agency S&P Global Ratings released its ninth stability rating for the stablecoins USDC, USDT, DAI, FDUSD, FRAX, USDM, GUSD, USDP and TUSD.

USDC, USDP, and GUSD were rated “strong,” while only USDM from Mountain Protocol was rated “adequate”. Stablecoins USDT, DAI, and FDUSD were called “constrained.”

The highest risk and lowest valued were FRAX and TUSD. None of the listed assets received the highest score in the current ranking.