As Starknet gears up for its highly anticipated STRK token airdrop on Feb. 20th, the perpetual futures market for STRK is witnessing a surge in trading activity.

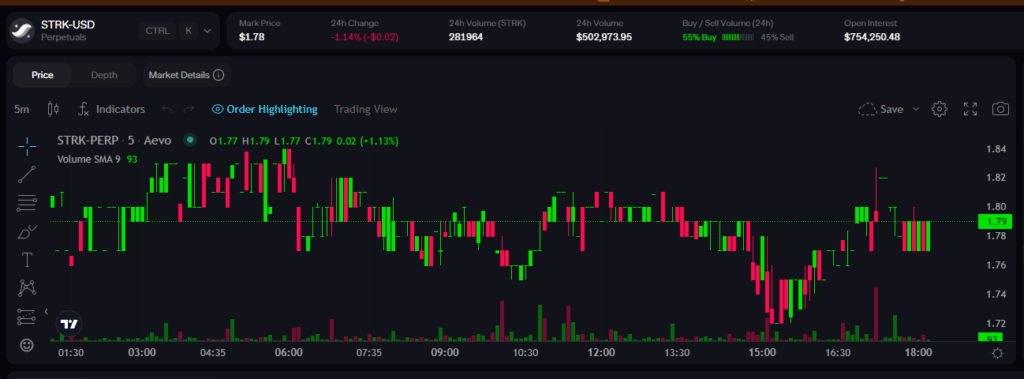

The anticipation of the airdrop has injected volatility into the trading of STRK-USD futures. The current mark price for STRK hovers around $1.78, reflecting a subtle 24-hour price decline of 1.14%.

Despite this slight downtrend, the market’s sentiment doesn’t appear to be dampened, as indicated by the past day’s buy/sell volume ratio, where buy orders outweigh sell orders at 55% to 45%. This could suggest that traders are optimistic about the STRK’s prospects post-airdrop.

The open interest of over $750,000 in the STRK-USD pair signifies a positive engagement from traders, who maintain their positions in anticipation of price movements triggered by the airdrop. Open interest in the context of STRK futures refers to the total number of contracts that are currently active or open in the market.

The Starknet Foundation is an Ethereum layer-2 scaling solution. The STRK token airdrop will start on Feb. 20 and run until June 20. Over 700 million tokens will be distributed to many participants, including Starknet users, Ethereum stakers, and non-Web3 open-source developers.

With this initiative, approximately 1.3 million wallets stand to benefit, marking a step towards allocating a total of 1.8 billion STRK tokens. Ethereum stakers and developers without prior Starknet affiliations will also be eligible for this airdrop.