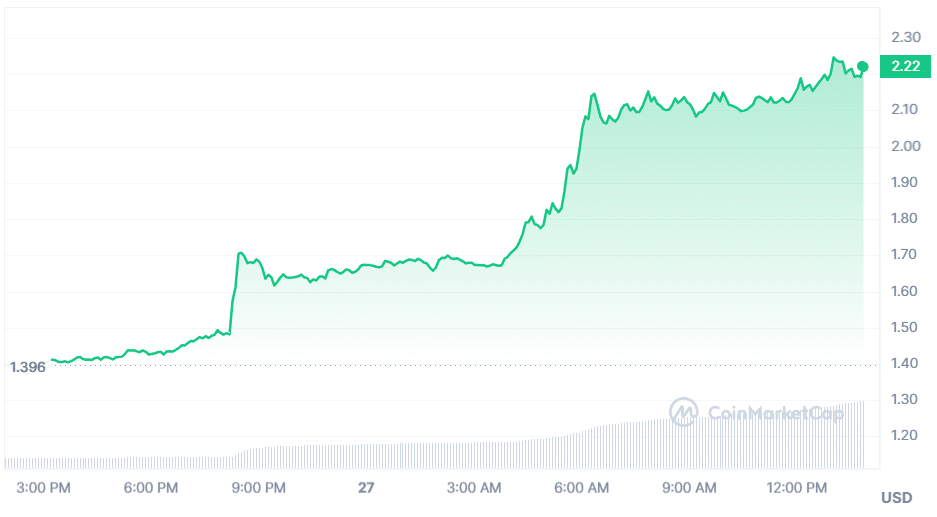

Theta Network (THETA) has secured the top gainer spot among the 100 largest crypto assets in the past 24 hours, printing a massive 58% surge amid the latest market resurgence that has seen Bitcoin (BTC) reclaim $56,000.

Notably, THETA had already been on a growth path before the recent Bitcoin rally. Following a drop to a low of $0.934 on Feb. 6, the cryptocurrency registered a massive comeback, eventually reclaiming parity with the dollar two days later.

THETA continued to record higher lows and higher highs until it clinched a high of $1.338 on Feb. 18. However, the reclamation of this six-week high introduced fierce resistance to the bullish momentum, leading to a price collapse and a subsequent consolidation between $1.121 and $1.3.

The token eventually leveraged the latest Bitcoin upsurge, breaching the pivotal $1.383 resistance stationed at Fib. 2.618 in an effort to reach higher values. THETA soared to a high of $1.816 yesterday, breaching the resistance territories at $1.555 and $1.662 in one fell swoop.

Interestingly, the crypto token recorded a 29.64% increase yesterday, outperforming Bitcoin and the rest of the market. The upsurge spilled into this morning, resulting in a push above the $2 mark, as THETA spiked to a high of $2.320, marking a 138% increase from the value of started this month.

THETA shorts face liquidations

Despite facing another roadblock at $2.320, THETA has retained most of the recent gains, currently up 58.7% over the last 24 hours, as it has become the biggest gainer among the top 100 assets. The uptrend has attracted immense demand for the token, as buyers enter the scene, leading to a 24-hour volume of $629 million.

Amid the bullish momentum, the derivatives market has witnessed mass liquidations affecting short positions. Liquidations impacting derivatives positions on THETA have reached $4.62 million over the last 24 hours, with short positions accounting for $3.27 million.

THETA currently changes hands at $2.26, trading above both the 50-day EMA ($1.172) and the 200-day EMA ($0.993). The token is looking to reclaim and seal a position above the $2.317 mark to retain its uptrend. However, this would largely depend on the direction of the broader market from here.