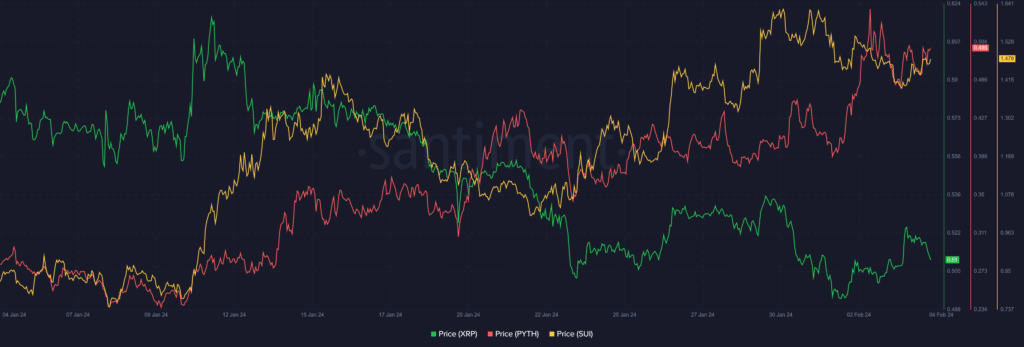

Among the top cryptocurrencies to watch this week are XRP (XRP), the native token of the Ripple network, as well as Pyth Network (PYTH) and Sui (SUI).

Each asset made noticeable contributions to the global crypto market cap, which remained above the $1.6 trillion mark over the past week despite the sustained market uncertainties, rising 1.86% to $1.64 trillion.

XRP struggles at $0.51

XRP has not given investors much reason to be optimistic recently, and this week added to these growing concerns.

The crypto asset began the week touting a 2.11% rise on Jan. 29. However, XRP gave up all these gains, with a 4.57% collapse on Jan. 30. This decline coincided with developments around the Ripple vs. U.S. Securities and Exchange Commission (SEC) case. The agency recently made a demand for financial documents from Ripple.

The decline spilled into the last day of January, leading to a breach below the $0.51, $0.50 and $0.49 support levels. XRP eventually dropped to a three-month low of $0.4855 on Jan. 31. Despite recovering the $0.49 and $0.50 territories, XRP ended the day bearish, closing January with an 18% crash.

The bearish pressure persisted amid a massive 198% surge in whale transactions involving XRP, as reported by crypto.news. Whale transactions spiked considerably to a yearly high of 1,827 on Jan. 30, with large investors compounding the existing selling pressure.

The bearish trend was further exacerbated by reports of a hacking incident affecting Ripple’s co-founder and executive chairman Chris Larsen. The Ripple chairman confirmed the hack, which led to losing $112.5 million worth of XRP.

XRP collapsed 5% on the heels of the event.

The asset has continued to struggle at the crucial $0.51 territory. XRP has defended this level zealously, looking to leverage it for an upsurge once the market recovers fully. XRP has recorded three consecutive green days in February, helping it to recover above $0.51.

PYTH looks to reclaim ATH

While XRP faced struggles this week, PYTH Network’s native token recorded occasional price spikes that contributed to its bullish end to the week. The token began the week amid a price slump below the $0.39 price threshold, changing hands at $0.3799 on Jan. 29.

PYTH witnessed a bullish structure that saw it breach multiple resistance levels, culminating in a surge to a yearly peak of $0.4457 on Jan. 30. The last time the asset traded above the $0.44 territory was in early December.

However, Pyth Network’s uptrend faced resistance at $0.4457, resulting in a steep correction. This correction eventually pushed the cryptocurrency below the recently breached psychological thresholds, as it collapsed to a low of $0.3890 on Feb. 1.

PYTH found its floor amid the retracement, setting the stage for a recovery campaign. Binance listed the asset on Feb. 2, compounding the recovery.

Upon the Binance listing, PYTH rallied 38% from the $0.3890 low to a high of $0.5392, slightly below the all-time high of $0.5487 attained last November.

An attempt to retest the all-time high was met with fierce resistance from the bears, triggering a mild correction. Despite this correction, PYTH fiercely defended the $0.50 level, trading for $0.5011 at the reporting time. The asset gained 32% this week.

Sui clinches 8-month high

Sui saw an impressive run last week despite recording more red days than green ones. The token kicked off the week with a massive rally of 17.19% on Jan. 29, closing the day above the pivotal $1.5 price threshold.

This uptrend spilled into the next day, with Sui surging to an eight-month high of $1.65. The last time Sui saw this price was in May 2023.

An attempt to breach the price territory resulted in a retracement. Amid this retracement, the asset eventually closed on Jan. 30 with a mild 1.12% drop.

Sui recorded another intraday decline on Jan. 31, dropping by 1.69% to close the day at $1.5187. The asset aimed to recover these losses at the start of February, but the bears mounted formidable resistance at the $1.5679 level. Despite the setback, Sui closed Feb. 1 with a 0.47% rise.

Sui continued to record declines, relinquishing the $1.5 and $1.4 psychological support. However, a recent recovery has seen it reclaim $1.4, currently pushing to breach above $1.5. Despite recording four losing days this week, Sui increased by 11.8%.