Bitcoin (BTC) has hit another all-time high, its third since March, and the altcoin market is growing alongside it. Why does this happen?

From the onset of the cryptocurrency era, Bitcoin was synonymous with “cryptocurrency” due to the absence of other digital currencies. Over time, though, thousands of new blockchain projects have emerged, each with unique applications. Despite this diversity, Bitcoin continues to be the dominant force, influencing market trends across the cryptocurrency spectrum. This article delves into why and how altcoins are so closely tied to Bitcoin’s market movements.

Altcoin season and its market influence

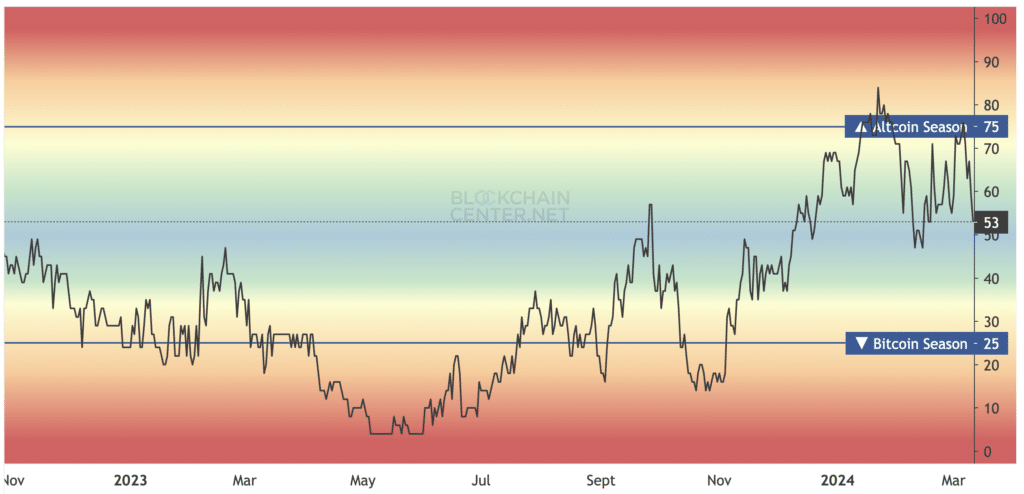

The phenomenon known as “altseason” typically follows a period of significant growth in Bitcoin’s value. During this phase, investors often shift their gains from BTC into various altcoins, aiming to maximize returns. One key indicator of an altseason is the altseason index, which offers a straightforward way to gauge the market’s status.

A value of 53 in the index doesn’t mean that 53% of investment capital is allocated to altcoins; it indicates that 53% of altcoins have outperformed BTC in the past 90 days. An index value of 75% or higher signals the onset of an altseason. In contrast, a drop below 25% suggests a “Bitcoin season,” where investments pivot back to Bitcoin, reflecting its market dominance and influence.

How does Bitcoin influence altcoin prices?

Since its inception in 2009, Bitcoin has maintained its status as the premier digital currency. While several early forks emerged, none matched Bitcoin’s popularity until Ethereum’s (ETH) debut in 2015. Bitcoin’s pioneering role and its perception as a dependable store of value catapulted its popularity, driving its value from negligible to over $70,000.

Bitcoin’s rise to prominence paved the way for cryptocurrencies to enter the mainstream. Its straightforward concept not only boosted its own value but also impacted the broader crypto market. Nowadays, most crypto investors hold some Bitcoin in their portfolios, underscoring its widespread influence. The greater Bitcoin’s demand, the more significant its impact on the market dynamics of other cryptocurrencies.

BTC dominance

A key factor in the current market dynamics is that many altcoins, especially those with significant capitalization, are traded in pairs with Bitcoin. Moreover, most coins aren’t directly purchasable with fiat currency, meaning traders often need to acquire BTC first.

As a result, if an altcoin holder decides to leave the crypto market, they typically convert their assets into Bitcoin before exchanging it for regular currency. This process tightly binds the value of many altcoins to Bitcoin due to these frequent transactions.

However, there are always exceptions. For instance, positive developments like an altcoin being listed on a major exchange or announcing an upgrade can drive its price up, even against the overall market trend. Such surges are often fueled by investors swapping their BTC for the altcoin in anticipation of a price increase.

The Bitcoin Dominance Index is useful for assessing the health of the altcoin market. This index indicates Bitcoin’s proportion of the total market capitalization. A decrease in Bitcoin’s dominance usually means a relative increase in the investment in altcoins. During periods of rapid crypto market growth, a significant drop in this dominance index is often observed.

Reserve assets

Bitcoin, often called “digital gold,” is seen as a stable and trustworthy asset in the world of cryptocurrency. Investors commonly compare other cryptocurrencies against Bitcoin’s performance. When Bitcoin’s value goes up, it can spark interest in various other cryptocurrencies.

Bitcoin’s role in the crypto market is increasingly similar to how the U.S. dollar functions in global stock markets—it’s like a reserve currency. Due to regulatory rules in some countries, certain cryptocurrency exchanges don’t allow direct trades of cryptocurrencies for regular money (fiat). In such cases, investors usually buy Bitcoin first and then use it to purchase other cryptocurrencies. Stablecoins, which are designed to maintain a stable value, serve a similar purpose. For instance, here are the latest reserves of the Binance crypto exchange:

Cryptocurrency values are commonly measured against the U.S. dollar, but it’s also usual to compare them with Bitcoin, as it’s a key component in major market pairs. This explains why the overall market often follows Bitcoin’s trends, whether rising or falling.

Predicting the altcoin market’s future

Despite altcoins historically following Bitcoin’s lead, future trends might differ significantly. Here are some scenarios and factors that could change this dynamic:

- Technological development and innovation: Many altcoins aim to address specific challenges or offer features not found in Bitcoin. If these innovations become foundational for real-world applications, altcoins’ reliance on Bitcoin could decrease.

- Mass adoption: If altcoins gain more acceptance among businesses, governments, or large organizations, their link to Bitcoin could weaken.

- Market diversity and specialization: As the crypto market matures, altcoins might focus on specific niches, making them less influenced by general market movements and Bitcoin fluctuations.

While Bitcoin still holds a central position, the future extent of altcoins’ dependence on it is an open question, subject to a range of technological, adoption, and market factors.